Seeking Capital Is One Thing... But Excelling With Capital Is Another

Raise. Deploy. Scale. Repeat.

Why do most startups fail?

Even experienced operators fail – 50% of the time.

Most VCs favor the founder over an attractive opportunity.

However, if the company falls short investors are inclined to cite the inadequacies of its founders – their lack of grit, industry acumen, or leadership ability and so on.

This is not always the case.

Top Reasons Why Startups Fail

Failed to raise capital

No product market fit

Got outcompeted

Flawed business model

Regulatory/legal challenges

Pricing/cost issues

What no one seems to talk about is that timing IS everything...

Geography matters.

Scaling is VERY hard.

Growth capital is increasingly difficult to raise.

And if you are outside Silicon Valley, fewer than 25% of companies that raise their Seed and Series A make it to the growth round.

It’s not too late for you.

If you are on a mission to solve a problem and you have already proven your MVP in your market, want to catapult you — giving you access to the funds, our resources, our global network, and celebrity branding, to impact more people in less time.

We accelerate your impact on the world.

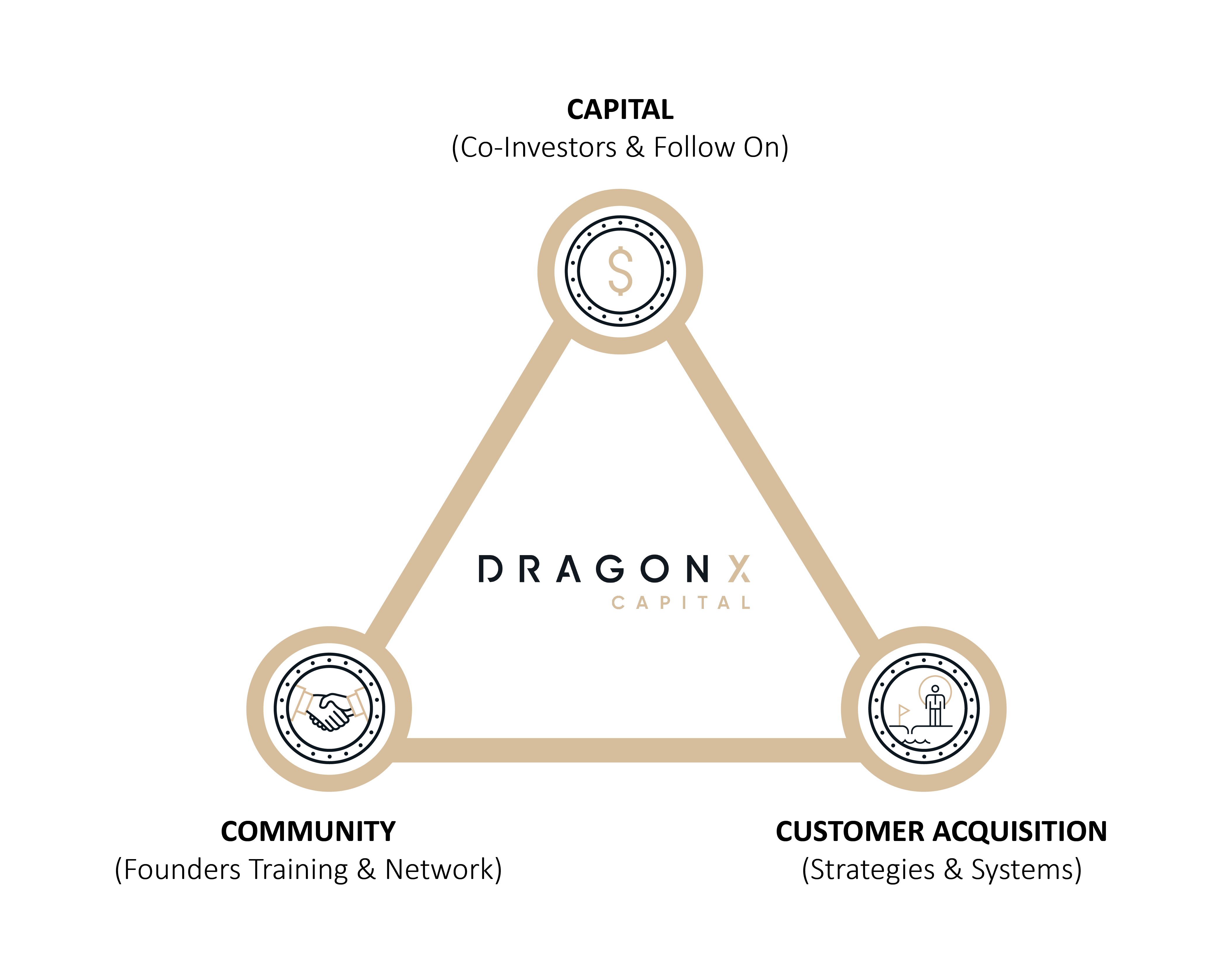

DragonX Capital has proven strategies, frameworks and community to remove preventable roadblocks. Consequently, we understand it’s your business and it’s up to you to take complete ownership and action to form the foundations to succeed.

Why founders choose DragonX?

Our simple, repeatable methodology radically propels your business forward.

Who do we invest in?

DragonX Capital invests in high growth start-ups, who have a minimum viable product (MVP) who have already gained some traction.

Before $5K MRR is usually a bit early, and if you’re over $100K in MRR, it is usually a bit late.

Are you a Dragon founder?

- Dragons are not just founders

- Dragons are visionaries, competent strategists, fearless leaders, and daring enterprisers

- Dragons disrupt, disintermediate, and shape industries

- Not everyone is made to be a Dragon - not everyone has the insight and drive to build the next billion-dollar company

If you meet the criteria above the next step is to uncover your specific characteristics or “X-factors.”

X-Factors We Are Looking For

The key qualities of a successful entrepreneur

- Ability to build rapport

- Can hire the best teams

- Can raise capital

- Can sell & evangelize

- Have grit

- Personal connection to the problem they are solving

- Are competitive

- Understand life balance

- Are agile & can pivot

To qualify, you must meet the following criteria:

| You are operating in "SaaS", A.I, Fintech, EdTech, and marketplace categories |

| You have a minimum MVP with some users |

| Your churn outlook is low and user base is starting to grow organically |

| You have a deep knowledge and passion for your industry |

| You value mentorship |