“If you can’t make it good, at least make it look good.”

Bill Gates

If you are planning on pitching VCs to raise money for your startup, there are several things you need to know.

First and foremost, you have to understand how VCs work:

They look for financial returns for their investors (LPs)

Raise funds

Find good teams & companies to invest in

Take “equity”, generally in the form of Preferred Stock

Help grow them

Bring managerial and technical expertise, as well as capital

Control some company decisions

Help them exit

The key is to understand how to work with them, and what makes them successful. Then you have to be clear about why you should partner with a VC, as the good ones can be great assets:

Value Add Funds

Recruiting

Sector & Domain Expertise & Advice

Growth & Exit Experience

Access to Other Investors

Managerial, Operational, & Technical Expertise

Objective Advice

Validation

And of course, what to watch out for, as the wrong partnership could be like a bad marriage. The most important thing is the alignment of objectives, clarity of shared vision, and chemistry. There are many things good VCs offer:

Guide and support the CEO

Help develop the team

Bring strategic expertise and view

Help identify the best technology stack, markets, product development, sales channels, partners

Offer networks & contacts

Help with finding talent, customers, partners, service providers, acquirers

Provide financial expertise and strategy

Help with business development

Advise on an exit strategy

The next thing is identifying the right VC. Because it is important to find the right ones and approach them properly. Most VCs do not take any cold approaches seriously. So you must get a warm intro. Keep in mind the following:

Sector & Industry Specialization

Stage

Check (Investment) Size

Geography

Competitive Portfolio Companies

Dry Powder

The Right Partner within the Fund

Track record

Resources & Mentoring

Quality of Network

Technical Expertise & Strategic Relationships

Chemistry

Reputation

Then you have to know your timing. As with many things in life, with raising capital, timing can mean everything:

Sector-specific macro conditions play a significant role:

Which competitors have sold?

Which competitors have raised money?

What is going on with key hires in the sector?

Is there consolidation occurring?

Is the sector becoming commoditized?

Have the key premium buyers already made their bets?

Assuming you have the right team and are raising money at the right time, once you find the right VC, get a warm introduction, and get in front of them, in addition to a first-class pitch deck, they are going to want answers to some key questions:

How much capital do you need to raise?

What are your pre-money valuation expectations?

What does success look like in 12 months?

Who is on the team?

What are you using the funds for?

Who is in charge?

What’s your go-to-market strategy?

What if you have to pivot?

What is your CAC?

How are you going to recruit talent?

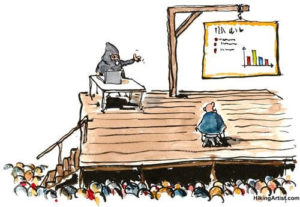

Making the Pitch

Investors have a short attention span

You must demonstrate passion & commitment

Remember, you are a missionary and not a mercenary

Your ability to build rapport is KEY

Show a personal connection to the problem you are solving

It’s all about storytelling

Do NOT be fixated on the presentation or the solution

If you can demonstrate the ability to build rapport with the investor, it signals:

Your ability to recruit employees

Sell the vision of the company

Acquire clients

Raise capital, and of course, deal with other investors

It is about an 18-month cycle

Know your landscape, be prepared

It’s all about the personal connection and storytelling

“The history of storytelling isn’t one of simply entertaining the masses but of also advising, instructing, challenging the status quo.” Therese Fowler

- Teaser Slide: Make it Clear & Memorable

- Elevator Pitch: 30 Seconds

- The Problem: BIG Pain that You PERSONALLY Relate With

- The Solution: How you are going to solve the problem

- Demo: Why You Are Better Than Everyone Else!!!

- Market Size: The overall target market and your initial slice

- Business Model: How Will You Make Money

- Proprietary Tech: What Advantages Do You Have

- Competition: Know The Competition and You Measure Up

- Go-To-Market Plan: How Will You Get Customers / Channels

- Team: Who Is On Your Team

- Results: What Have You Achieved So Far

- Capital: What Do You Need & How Will You Use It

Many VCs have guest lectured in my classes at USC, and they say the same thing. They look for patterns and usually make up their minds within the first few minutes of the meeting. And the first time CEOs have over 30 meetings before they raise money. So, keep in mind what Theodore Roosevelt famously said, “In any moment of decision, the best thing you can do is the right thing, the next best thing is the wrong thing, and the worst thing you can do is nothing.”